Why OHM and co are scams

Except Sharknado Pupper Protocol

The last cycle saw the rise and fall of a new type of ponzi, the ‘rebase token’. These projects (Ohm, Wonderland, Klima, Snowbank, Snowdog) were all much-loved at the time, primarily because people were making money off them.

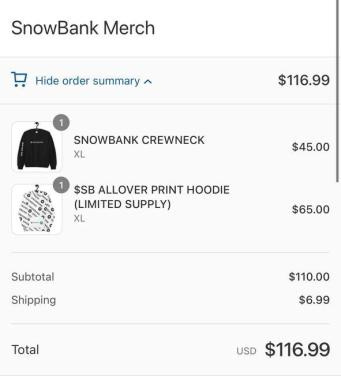

Each had their own special twist or niche to make them unique. It would take an entire university of anthropologists to document all the weird cults and memes that cropped up, and a fair chunk of the FBI to track down and arrest all the scammers and grifters involved.

I’m sure better people than I have done, or are doing this. I’d just like to take a few minutes to talk about why they’re all scams and how the scam works.

The basic tokens

There are a few tokens that are required in this scheme that all work together. I’ll use Time/Wonderland as an example, but every protocol had their own versions, and specific protocols may have extended things with other tokens.

TIME - This is the basic token. Initially it was the only token you could buy/sell in an AMM. You can stake this token in a contract.

MEMO - This is the token you get representing your staked TIME. You can unstake your MEM( to get TIME back. The amount of MEMO you own automatically increases every eight hours (AKA the rebase).

wMEMO - You exchange MEMO for wMEMO (and back) at a multiplier that increases every eight hours when the rebase occurs. This token isn’t strictly required but it enables some uses cases like Defi.

The workflow is that you acquire TIME by buying it or ‘bonding’, stake it to MEMO, and then optionally wrap it to wMEMO.

New TIME

New TIME can be created in two ways:

TIME that is staked to MEMO, which increases via rebases, and then unstakes back to TIME.

By ‘bonding’. This is when you give the protocol some kind of collateral (MIM, AVAX, ETH, or TIME/AVAX LP) and it emits you back new TIME over the course of a few days.

Bonding is interesting from a game theory perspective, and it contributes to what makes this a ponzi, but it’s not a central point and I’m not going to bother with further detail.

Bullshit, lies, and obfuscation

I said I wouldn’t talk about the culture, but this stuff comes up in every discussion and I want to explain how it’s irrelevant before the nuts and bolts are discussed.

These tokens amass cults, and if you don’t think it’s ponzi, you’re probably an unwitting cultist. This applies to any token really. If someone is telling you that something is a scam, you should think critically about it instead of just believing the propaganda. Just because you seem to be making money, doesn’t mean you can’t rapidly lose all of it.

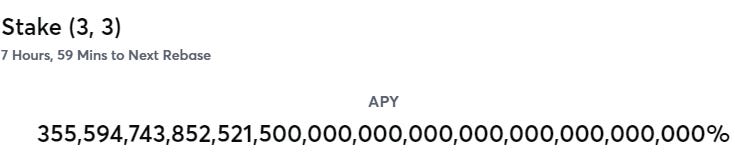

‘3, 3’ and other game theory is bullshit designed to get you to not sell. There’s no way that everyone will make money. The money comes from somewhere.

The ‘runway’ that these tokens display is bullshit. It doesn’t mean anything. Ask them to explain it and they’ll come up with all kinds of nonsense about how ‘it pays out the rebases’. That’s not a thing, completely unrelated to how the tokens work.

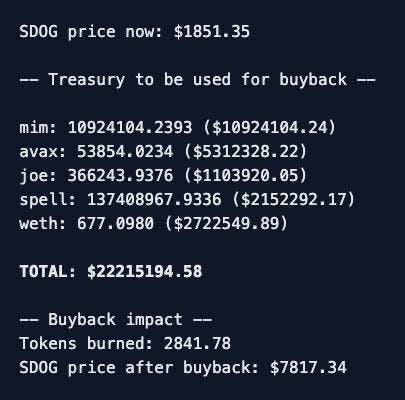

‘The protocol will do buybacks’ has largely been proven to be lies. Some of them did do them. Some of them did them unevenly. But regardless, the ‘fair value’ of a rebase token during one of these manias is generally well below the market value. If the treasury drops below that point you’re probably already rekt.

‘The treasury is earning’ is obfuscation. Sure it’s probably earning some income… but it’s doing that with your money. If you held the money yourself and put it into those protocols, you’d be earning the same amount. If the market value of the token is higher than the fair treasury value, then you’re taking a direct haircut.

The mechanics of the ponzi

The ponzi seems to make you money because of the interaction between the way that an AMM works, and the amount of rebase token. Lets do a hypothetical example:

100 TIME total is in existence.

10 TIME is paired with 10 AVAX in a liquidity pool.

90 TIME gets staked in return for 90 MEMO.

10% of the outstanding tokens in the pool as liquidity is a pretty rosy assumption, but lets go with it. At this point:

Bob can sell one TIME for .91 AVAX (accounting for slippage and fees).

Alice can sell one TIME for .76 AVAX.

Dave can sell one TIME for .64 AVAX.

Assuming all the remaining 87 TIME are sold into the pool, the price of TIME is now 50c.

But lets say they’re all hodlers and no one sells anything. Eight hours later, a rebase occurs.

Ding, you now have 10% more tokens

These rebase tokens have insane APRs. 10% per rebase is insanely high even so, but lets do it just to make the numbers easier.

There are now the equivalent of 109 TIME in existence. 10 TIME in the pool, 99 MEMO held by owners.

The market cap of this token increased by almost 10% like magic! Everyone somehow magically got richer!

But not really. You just got richer in respect to the liquidity pool. The LP got poorer because the tokens in it are not staked.

Now:

Bob can sell 1.1 TIME for .98 AVAX.

Alice can sell 1.1 TIME for .82 AVAX.

Dave is worse off than before and can sell 1.1 TIME for .60 AVAX.

If everyone sells out, the price of TIME is now 45c instead of 50c. The last people who sold out last got less than before, even though they had more tokens.

Ding, ding, ding, ding, ding, ding, ding

Lets be realistic though, everyone joined these projects for the lambos. You could have multiple lambos after a year if you held, given the crazy annualized yield.

So lets do an experiment where we assume everyone is an ultra hodler and they hold their tokens for a month at 10% per rebase.

Bob now has ONE MILLION TOKENS (did not do the math).

Based on the token price, Bob is now a millionare, just like everyone else.

Bob decides to casually take some profit and swaps all his tokens for AVAX. He somehow gets only 9.9 AVAX in return.

The other holders, each with a million tokens, share the remaining .1 AVAX.

Oops.

It’s that simple

Everything else is just window dressing. The ‘3, 3’ game theory, the memes, the cult, the buy and hold, bonding, the lambo calculator, the runway. All part of the scheme to get people to buy, and not sell.

And it works. If you play the game right you can even make money off it, even though it’s a ponzi. You can make money off price appreciation of your tokens if more people ape in. You can make money off the pesudo appreciation against the LP. But you should be realistic about what’s going on.

That money comes from other people who lose, it’s not magicked up out of nowhere. Those people tend to lose hardest at the the absolute end of the ponzi, stuck holding worthless tokens. If you want to play the game, don’t be one of those people.

And personally, I recommend not being one of the cultists or the shillers for the scam. It’s one thing to gamble and win, it’s another thing to convince people to lose the gamble.

B O N U S C O N T E N T

One of the innovations that helped extend this ponzi was the creation of the ‘wrapped’ version of the tokens. These tokens ‘continuously went up in price’ as rebases occurred, like magic!

That makes them really great collateral! So some protocols (cough Abracadabra cough) started accepting them and allowing people to mint stable coins against them.

This VASTLY reduced selling pressure and allowed people to ‘take profits’ on those coins without actually selling them.

Even more egregiously, they upgraded their (3, 3) bullshit propaganda to (9, 9), ensuring people got COMPLETELY rekt in the end. Why do a vanilla ponzi when you can do a leveraged-ponzi right?

Ultimately this was responsible for a very rapid price crash. Some people (cough Dani cough Sifu cough) took out enormous loans against their wMEMO. This effectively let them cash out early without obviously dumping their token.

Needless to say, they didn’t bother to pay those loans down as the price dropped, that would be throwing good money after bad. So they got liquidated which led to chain liquidations that wiped out tons of other people who borrowed against wMEMO, causing a cascading price drop and basically making all the frogs poor.

![[webp-to-png output image] [webp-to-png output image]](https://substackcdn.com/image/fetch/$s_!dfyx!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2Fdf96e79e-bc80-4b6b-b7dc-20ee29abb0e9_1059x571.png)