Launching $wink

The Canadian Anti-Fraud Centre’s wet dream

Welcome to the first ever (I think) guest article on Tactical Retreat’s Substack! This is Smitty, aka TR 0.5, here to talk about the Wink launch. Apologies in advance as this has been a very stressful week and my attention is still frayed. Hopefully I don’t ruin this for all potential future guest authors by posting an absurdly long, poorly edited ramblefest.

Editor’s note: this is Part 1 of 2, see part 2 by tactical_retreat here.

My role in WINK

I was only tangentially involved with the launching of WINK of course, but for the purposes of this article I will write as if I was the sole developer in charge of the rollout plan. This is hypothetical and will never be mentioned again.

I DID NOT REVIEW ANY PRESALE APPLICATIONS. Plenty of my friends/community members didn’t get in. I was able to bully Goose into giving my own projects under the Dev and Draw umbrella a presale allocation (nice shameless plug there, am I doing this right?), but that was my only interaction with the selection process.

I proposed launch plans, workshopped them with Goose and other dev friends, then executed them. I’m working with the team on a contractual basis and as far as I’m aware have no token allocation. Maybe it’s not too late? .5% or something? You have my number.

The Problem

So what is our problem?

Thankfully we had a launch discussed on this very substack not long ago that perfectly highlighted our problem! Feel free to leave this subpar post and go watch the master at work discussing the launch of $$AIGG here.

In short, there were tons of buyers in the same exact block the liquidity went live which spiked the price massively. These “snipers” are typically purely profit motivated with no interest in a project in particular and thus are more likely to sell their tokens at any sign of life. At the very least they’re raising the price for the average joes trying to buy on a DEX.

We want as many tokens as possible in the hands of people who are likely to hold them. Snipers are not likely to hold tokens, and are more likely to dump them after actual interested parties have bought in. This is bad. We don’t like it.

What is a sniper?

When people think of snipers, their first image is the type of advanced mempool snipers that AIGG fell victim to. These are people who are buying immediately, likely less than a second after the launch.

However, if our goal is to maximize the amount of tokens that are in normal community members’ hands, we might want to expand this description. But how far do we expand it? Here’s a rough list of different ways people might buy WINK, loosely organized from “most sniper” to “least sniper:”

Watch mempool for any $WINK token and buy it

Track liquidity funds and have a bot buy any token deployed by team

Twitter scanner bot that buys any CA found in tweet

Bot tracking all AVAX deployments, has a UI to one-click buy

Bot tracking all AVAX deployments, paste CAs into another bot

Do snowscan analysis, paste relevant CA into another bot

Wait for account to tweet, trade CA on dex

I think the general consensus is that the first 2 options would be traditional snipers. These are the classic bad actors that pretty much every launch will make an attempt to prevent.

After that we get into the territory of what I would consider “soft snipers” or just very sophisticated market participants. They’re still trying to gain an advantage over the majority of buyers, they just don’t have the technical ability of true snipers. This is where things get more grey.

For Wink’s launch in particular, given the insane amount of hype and mindshare it had, we decided that many of these “soft snipers” were likely motivated similarly to traditional snipers. These are probably people from other chains looking to make some quick money on a highly anticipated launch.

With this thesis in mind, we wanted to maximize the amount of normal, strong community members that would be getting in via DEX.

The Plan

With our goals now clear, we needed a plan. Let me start by saying that it’s pretty much impossible to stop bots. Anything a human can do, a bot can do better. If you’re a reader of this blog surely you know this by now. So what can we do to accomplish our goals?

Well I’ll tell you what we can’t do. We can’t just transfer the funds to a wallet and deploy a single, legit $WINK token. This would obviously get eaten up by pretty much any kind of sniper on our list, leaving normal market participants (see: majority of our community) demoralized.

So we need to deploy more than one token. TR pioneered this with $KET before, deploying 10 different tokens along with the actual legit KET token. However, it didn’t do all that much for him–only 1 (I think, not gonna fact check this) person bought any of the decoys.

TR launched all of his decoys with only .1 AVAX in the LP, and it turns out most snipers are smart enough to figure out not to buy those. With so many more eyeballs on our launch, we needed to do better. I modified the KET script a bit to instead launch LPs with full liquidity, wait 4 seconds, then send the remove LP transaction. Our launch LP was set to be 9000 AVAX, so in practice this led to a decoy 9000 AVAX LP $WINK token being launched roughly every 20 seconds.

In addition to this, I thought it would be fun to split our funds into two wallets each with 9000 AVAX to keep people on their toes. The first wallet would be constantly looping decoy LPs. The second wallet would launch a single decoy LP, pull it, then transfer funds to a new wallet and launch the actual token.

With this plan, we’re making it INCREDIBLY hard for any of the snipers to get wind of which contract is a decoy and which is legit. “Soft snipers” or highly sophisticated actors will also find this basically impossible to navigate, paving the way for a large portion of buyers (or at least larger than usual) to be just normal AVAX enjoyooors.

Launch day

Obviously this targeting of snipers of all varieties is a bit of a grey area. We didn’t want to just take unsuspecting people’s funds. It’s also kind of arbitrary which token will be the correct one, so we made sure to tell people ahead of time that we would ONLY be announcing the correct token on our twitter and buying anything else before our announcement would end in trouble.

After seeing Goose’s announcement and knowing our plan, this didn’t seem like a harsh enough warning. I wanted to make ABSOLUTELY CLEAR that people who buy anything without checking our twitter first will get rekt. So I suggested a second announcement:

Ok, well now I’m feeling good. We’ve made it clear that people shouldn’t try to buy before we tweet and that we’ll be doing everything we can to make sure nobody snipes our launch. With that out of the way, we were ready to begin.

After I finished my final pre-launch tests, since we were planning on looping a bunch of deploys anyway, I decided to run just a single manual test of adding/removing LP from the main looping wallet before kicking off the script that does this repeatedly. We’ve now warned people not to snipe with varying levels of intensity, telling them to wait for a tweet. And if you’ll remember from earlier, the absolute most basic thing we could do is launch a single token directly from our main funded account. Surely nobody will fall for this test one right? Right?? RIGHT???

Well at this point you know what happened here. That first token was live for all of 17 seconds before the liquidity was pulled. When I checked the wallet again to start the actual script I thought something had gone wrong. How could the wallet value have 2x’d? Did I accidentally send all the funds to one wallet instead of splitting them into two?

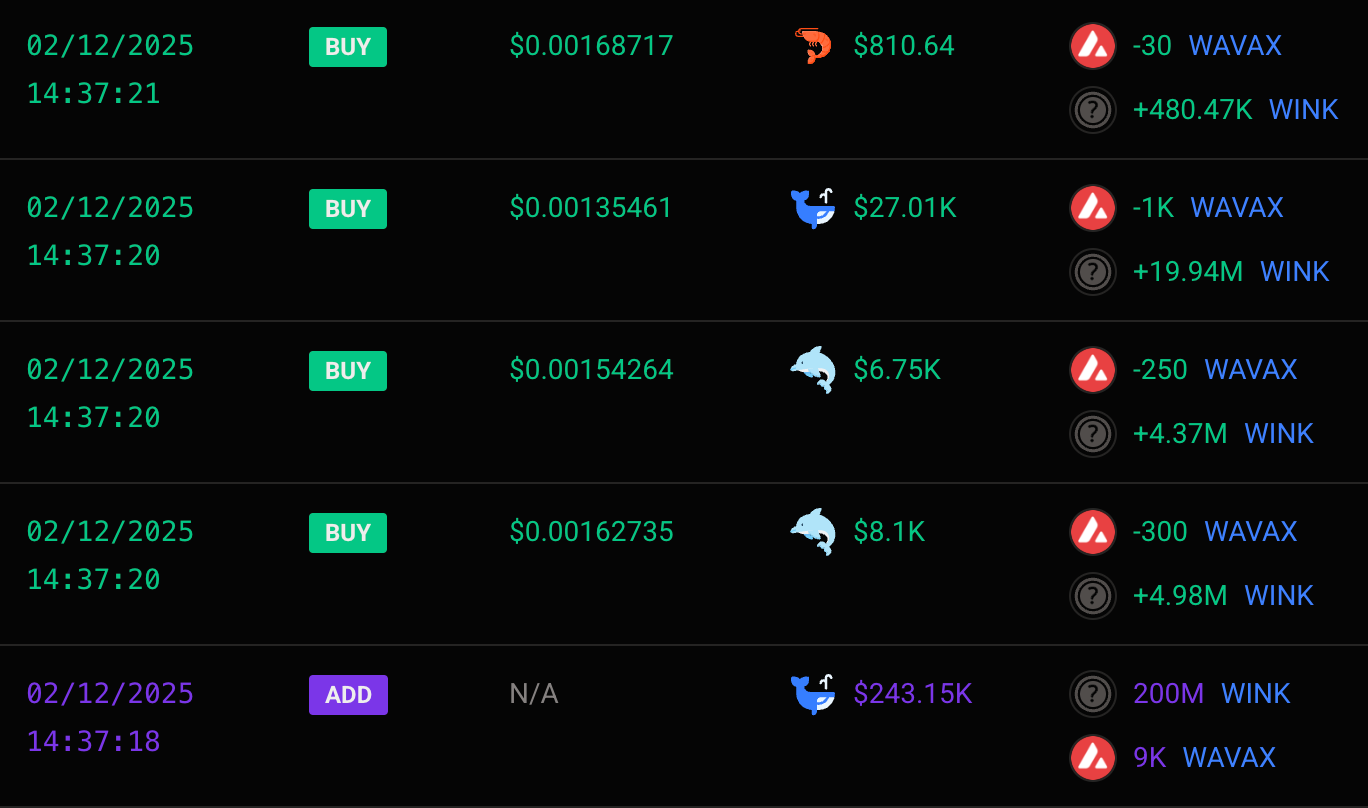

I #CheckedTheChain and saw that somehow the liquidity remove TX returned 18,000 WAVAX to our wallet and shock started setting in. After our multiple warnings and clear messaging that people should wait for confirmation, fellow blockchain enthusiasts dumped NINE THOUSAND AVAX into the very first, most basic possible contract launch we could have done. In 17 seconds.

There was nothing left to do at this point but continue on with our plan. I got a second computer set up with the launch tweet ready to go, ran my scripts, and fired off the tweet right when I saw the main deploy going through.

There were some minor technical issues towards the end of the launch. The airdrop was delayed about 10-15 minutes after launch due to gas spiking immediately.

Also I had accidentally yeeted the team allocation into the $KET multisig. Shout out to the Wyoming local government for getting us those funds back asap.

Editor’s note: This is because we shared the same codebase, not just a completely random accident.

Reactions

Obviously since we had such an extreme launch plan, there was some backlash.

Based on the people who are upset with us it seems like the plan did a good job deterring the kinds of people we were trying to fight (sniper group extractors + French soft snipers).

We very clearly said to just wait for the tweet and buy–anyone who did not do this took a gamble that they could buy the right token early and dump it on your head like they usually do. As TR would say, they bought tokens at the price they were willing to pay. Snipers will complain that we “couldn’t find actual anti-snipe methods so instead did this out of laziness/incompetence.” They’ll make this complaint because they know that they could have bypassed any “actual” anti-snipe like they always do. Meanwhile, most normal people enjoyed this launch strategy and seem to be happy with our approach.

Successful Soft Snipers

The first buy on the actual WINK contract was 16 seconds after liquidity was added, which you’ll notice was about as long as the decoy contracts were live. Interesting that the decoy contracts had 9000 AVAX worth of buys in the same amount of time it took the real contract to have its first buyer. Surely those decoy buys were organic!

As I said earlier, it’s basically impossible to stop snipers in all forms. The best we could do is try to delay them as much as possible and close the gap between them and normal buyers, which I feel pretty confident we did.

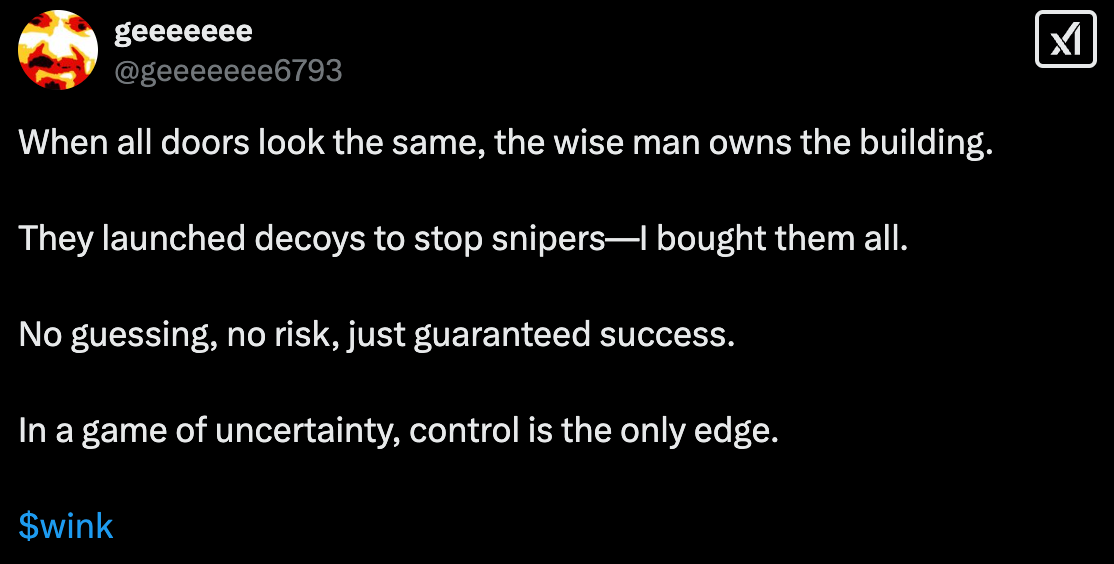

The first buyers on the real contract would still be some form of “soft snipers” or very intelligent market participants though. Does anyone know of any very intelligent market participants?

Insider Trading???

I feel compelled to address this because it will certainly come up (and has already) once people do more research into the launch. Yes, some notorious botters (friends) led by the destroyer of projects got decent entries to $WINK.

It would be easy to cry about insider trading here, but if anything the reality is closer to the opposite. Let me give you some more context on the situation and you can make your own decision.

Wink was a massive launch, and I couldn’t afford to give anyone special treatment. It had to go smoothly, and so I used my knowledge of my friends’ setup to inform our release plan. With the hype around this launch, there may even have been others with similar setups.

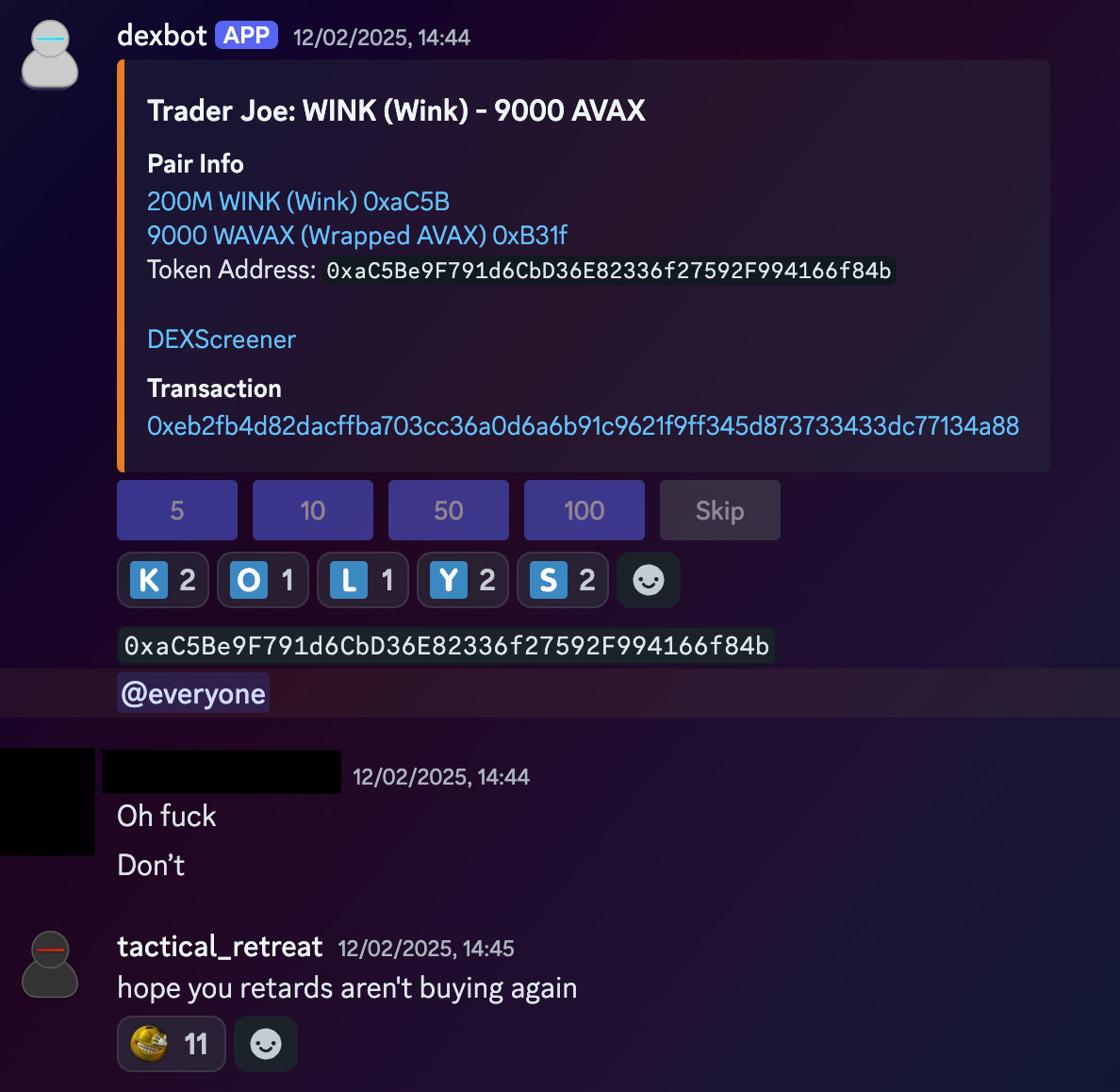

For starters, you may have noticed an oddly specific bullet point in my list of potential buy methods earlier: “Bot tracking all AVAX deployments, has a UI to one-click buy.” I believe Tac will be publishing (or has already published, this is taking forever to finish) a blog post with more detail later, but this is what he has been running for our friends. Part of the reason for spamming liquid WINK deployments was to clog their feed.

I also knew people would be watching our Twitter carefully, potentially even with bots that auto-buy CAs in Tweets. I was planning on having the CA in a picture in the announcement tweet, but then I saw that Tac’s Twitter bot was displaying images as well so I cut that and used a url shortener to the launch page so that nobody could get the CA from the tweet alone. I know this annoyed people, but I figured there would be lots of other people closely monitoring the Wink page and wanted to slow them down as much as possible.

I had no interaction with any of my friends during the launch (I was too occupied to look anywhere outside my terminal) and gave them no heads up on the launch strategy or timing. I specifically designed parts of the launch plan around sowing confusion for them. These are some of the most sophisticated actors I know (well, Tac is anyway), and so if I could slow them down I was probably slowing lots of others down.

And slow them down we did! I didn’t read the chat until preparing for this article, but it's a gold mine in there.

Eventually the real contract launched with the tweet at the exact same time, and someone in the server resolved the URL fast enough to send it to the rest of them. It probably also helped that the tweet timing was so exact with the liquidity going live, but it had to be that way so there’s nothing we could do about that.

My own girlfriend, who was in the room with me at time of the launch, bought a decoy USING MY OWN MONEY THAT I GAVE HER TO BUY WITH FOR ME. I will be joining the class action lawsuit against Goose.

These are exactly the type of people we were trying to slow down (sorry friends) and despite some of them getting in early anyway, I feel happy with our efforts. Our goal was to give “normal” market participants as fair a shake as possible and I think we did that. If you can point me to another hyped token launch where the first buy didn’t come through until 16 seconds after launch, I’d love to see it.

Editor’s note: Hello? Ket launch? This is libel, I will be contacting the Canadian Government.

Closing Thoughts

Overall I feel pretty good about our launch strategy. I think the people that are upset just got caught with their hand in the cookie jar trying to outsmart us and are mad about it. They didn’t think we’d go to the lengths we did to stop them, took a gamble trying to make money despite our warnings, and are trying to recoup unexpected losses. As I mentioned above, many of my friends bought decoy tokens and are (mostly) accepting that they took a risk and it didn’t pan out.

Obviously the launch was not flawless. The script had a 4 second pause before removing liquidity but with transaction transit times each token was live for about 15 seconds which is probably too long. I’d also prefer to combat snipers in a way that leaves no room for moral ambiguity, but there really just isn’t one. I’ve seen some truly horrible analogies calling this theft and I look forward to seeing how they hold up in court.

I’ll leave you with some wise words of advice from one of our aforementioned sophisticated market actors:

Hahahahaha wow i hope kieks got a smacking smitty

Awesome article Smitty! You all nailed it on the launch and it made for both an informative and entertaining read!